Gil’s Musings

Recession? Who Knows?

Economist Paul Samuelson famously quipped that “the stock market has predicted nine of the past five recessions.” This tongue-in-cheek expression reflected his view of jumpy stock investors’ impact on the market, who pile in and out, often letting fear win out over fact.

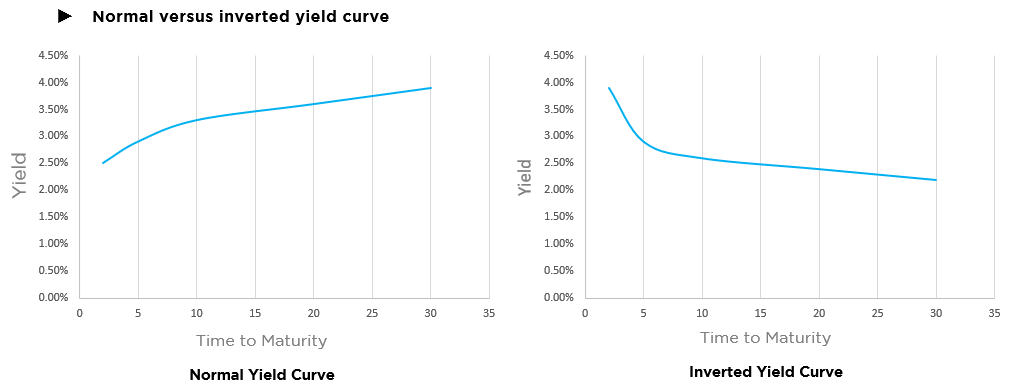

Current tea leaf readings might have one conclude that a recession is imminent, and that may be true. The bond market gives pretty reliable clues, an inverted yield curve among the most notable. To explain the inverted yield curve, you should understand that typically bond investors require more yield for the risk of lending their money for longer periods of time. This natural requirement is depicted in a graph like the one on the left below, with yields that slope upward and to the right.

But occasionally, shorter-dated bonds pay more than their longer-dated counterparts. For instance, on the last day of trading in 2022, three-month T-bills paid 4.4%, while ten-year T-notes paid 3.88%. This is yield curve inversion in action, which normally occurs when bond investors expect a rate decline in the future due to weakening economic circumstances. This inverted curve has been a pretty reliable indication of recession expectations but has not always foretold accurately. It is also worth noting that both the current 3-month and 10-year Treasury rates lag significantly behind the current rate of inflation, which is north of 7%. Therefore, it is clear that bond investors across the spectrum expect inflation to drop.

Strategically, Segment tries to limit its changing of bets, but we do trim around the edges. For example, recent strength in oil company share prices despite commodity price weakness had us reducing positions. However, you can expect us to accumulate more if the shares catch up and weaken.

In the meantime, we are buying more bonds for clients who like the safety of such investments now that rates have risen. We dragged our feet throughout 2021 and stalled on reinvesting maturing proceeds while letting cash build. Rates were just simply too low to commit. That is a good thing, too, because rising rates would have crushed almost anything we would have bought.

When we do buy bonds, we usually limit ourselves to ten-year maturities so we can endure setbacks of rates rising further. We have been more active of late. Philosophically, we don’t view bonds as actually producing a return since yields are mostly compensation for the erosion of purchasing power due to inflation. This makes bond investing a tread-water game; the low return is the price of entry to a very predictable outcome. In our view, the purpose of a bond is to not act like a stock.

Last year was brutal for 30-year bonds, with prices dropping over 20%. That’s hardly any solace in the stock market storm. Segment’s client bond holdings last year dropped significantly less, more on the order of -5%, due to our avoidance of long maturities.

We will continue to monitor the inflationary and recessionary trade-offs and will do our best to navigate them as best we can. In the meantime, good riddance to 2022.

Please see IMPORTANT DISCLOSURE information.