Gil’s Musings

Market Optimism

Longtime readers of my musings will surely perceive me as part cynic with an optimistic bias. I would never be perceived as a pessimist.

I’m a cynic when it comes to the nature of humans but an optimist when it comes to the nature of markets. To be a pessimist, I would have to believe that markets are somehow doomed or that people are irredeemable. Neither is true. And when I speak of being a human nature cynic, rest assured I’m putting myself in the same category. I’m not judging people from some lofty height; I’m in the muck with all the other sinners. However, I have a unique vantage point, and by observing my own mistakes and those of so many others, I have insight into what works and what doesn’t. One of my most strongly held and loudly professed beliefs is the wild advantage of sitting still.

Even though the government intervenes too much and manipulates capitalism for its own advantage, I’m not sure they can break the system. Nevertheless, California is providing a convincing test case that the Federal Government seems to be mimicking, so we’ll see. Despite the government’s seeming attempts to distort and undermine the system, markets remain buoyant. Thus I share many investors’ concerns about how the system has been twisted, but I remain optimistic. I have often likened the markets to a cork. You can pull it down, but its inherent qualities will force it to find its way to the surface.

The point I’m trying to make is that when the investing atmosphere reeks of pessimism, the market is likely giving you signals to the upside. Most people don’t see those signals at the time because our fear gauge gives too much credence to the actions and opinions of others. But remember, the markets are an auction. The absence of other bidders is what creates the opportunity. When sellers outnumber buyers, prices fall. After those sellers run out of steam, there are only buyers left. When this dynamic is coupled with a sudden news shift, stampedes can ensue. Many people believe they can gauge or predict these waves and somehow trade themselves to advantage. Yet, the data routinely shows that staying put is best policy. The annual Quantitative Analysis of Investor Behavior report published by DALBAR since 1984 shows that retail investors consistently make decisions that harm themselves. Considering that historically the stock market rises in 81% of all 12-month periods and that investors generally make the wrong choice at the wrong time, a policy of staying put trounces the math of making changes. To put it simply, there’s an 80% chance you will be wrong by selling in a weak market and an 80% chance you will be right if you do nothing.

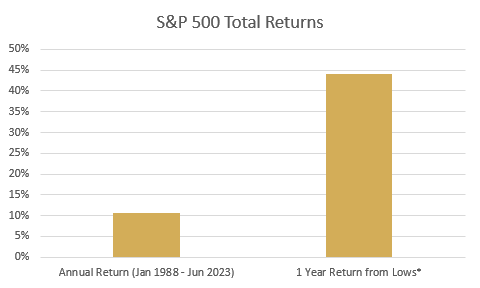

On the other hand, if you added risk in a down market, your odds of success would far outstrip the 4-1 odds I just explained. That’s because the recoveries can be swift. When the market bottomed on March 24th, 2020, in the face of widespread COVID panic, the market was up 17% in the following three days. Nine occurrences of -15% or greater downdrafts have occurred in the past 35 years. The average gain in the six months following the low was +30%, and the average gain in the following 12 months was +44%. While 2000 and 2008 would have briefly hurt had you entered the market for more abuse after the first 20% decline, those additions would have stung only momentarily and then would have been responsible for much better overall results thereafter.

*Average one-year return after the market hit lows in the nine 15%+ corrections since 1988. For the 2022 correction, we use returns to date as of 7/12/2023.

It is admittedly hard to buy more with a -20% decline in the rearview because our self-preservation instincts say it will surely go to -30%. But history would argue otherwise. That’s because the occurrences of -30% declines are so low that the likelihood is that you would have missed more opportunity than the incremental losses you would have avoided. The next time you see a 20% decline, it’s probably best to hold your nose and dive in.

Please see IMPORTANT DISCLOSURE information.